CFDs and Spread betting are very similar, so how should investors select between Spread betting vs CFD?

Spread Betting vs CFD – table of contents

Quite often you’ll find that investors go for one or the other based on their personal preference. In CFD trading as well as Spread betting, investors can go short or long based on how they predict the market will move.

In both Spread betting and CFD, you never own any sort of physical assets and hence the great news is that traders are not legally responsible to pay any stamp duty.

Spread betting, like CFD trading, can also include a high degree of influence, which can boost your revenues. Though, this also means that whether you do Spread betting or CFD, they both can amplify your losses as well.

What is spread betting? Spread betting meaning

Spread betting, unlike CFD trading, is a strategy in which you speculate on whether an asset’s price will fall or rise.

Your stake is right up to you, as you decide how much you want to bet each point of movement. When you spread bet, you are betting on several possible outcomes, based on the underlying data.

Two prices are quoted for spread bettors – the bid price at which you can purchase, and the ask price at that you can sell.

The main difference between the two prices is known as the spread. Brokers will get a small part of this spread as income, without adding commission to the trade.

Investopedia article on Intro to Spread betting

How Spread betting works? Spread betting explained

Spread betting work by tracking the worth of an asset. You take a position on the underlying asset without getting ownership of that asset.

There are a few major concepts about spread betting you have to know, including:

- Margin – the amount of capital you have to put when placing a trade. It is generally a percentage of the total traded amount.

- Long and short trading – Long means buy, Short means sell. Read more on my Long and Short in CFD trading article.

- Leverage – a huge spread betting benefits but also a double edged sword. For a beginner, it can do more harm than good.

Spread betting benefits

There are many benefits of spread betting when compared to CFD trading. The main advantage for spread betting and one of the major differences of spread betting vs CFD is that entire gains are free from stamp duty and Capital Gains.

Following are further spread betting benefits:

- Spread betting lets us trade numerous markets

- No commission on spread betting vs CFD is one of the biggest spread betting benefits

- Simple to bet in the currency of your choice – superior control of currency exposure

- Trading with spread betting allows us to bet on prices falling and rising

- Spread betting provides us leverage meaning our capital works harder

- Spread betting, unlike CFD, has no commission charges – you just pay the spread

- trade with rolling regular funded bet agreements that have an expiry date.

- 24hrs dealing available with most brokers

Disadvantages

- The only drawback of Spread betting vs CFD trading is that we can’t trade with Direct market access (DMA). This means we are not able to place trades straight onto the order book.

What is CFD trading?

A Contract For Differences, or CFD in short, is an economic derivative based on the fundamental market. You purchase or sell agreements that represent an amount for each point in the market.

This is the same as what you’d do when trading the physical instrument, but without getting ownership of the fundamental asset.

As this is a trade on margin, you can easily open a relatively huge position utilizing a small amount of capital and therefore can lose or win significantly more than you invest initially.

When trading Contracts for Differences vs Spread betting, you sell or purchase several units or specific amounts of CFDs in an instrument, just like when you would be trading the actual instrument.

With CFD though, you do not own the underlying fund and can trade on margin. This lets you take a position with a notional worth much more than the value of money you’re needed to deposit.

Advantages of CFD

The main benefit of CFD trading vs Spread betting is that we can have direct market access on the order book when trading CFDs. This means we can get better prices since we are dealing with a lower spread.

Here are other benefits of CFDs trading:

- CFDs let us trade several markets

- CFD trading is leveraged meaning capital works harder

- Direct market access on shares and forex

- There’s no stamp duty

- Trade on falling and rising markets

- CFD prices are based on the fundamental market

- 24hrs dealing in 99% of markets

- Losses can be offset profits for tax purposes

Disadvantages of CFD

- The main drawback of CFD trading when compared to Spread betting is that they’re not exempt from Capital Gains Tax

CFD trading vs Spread betting – head to head comparison

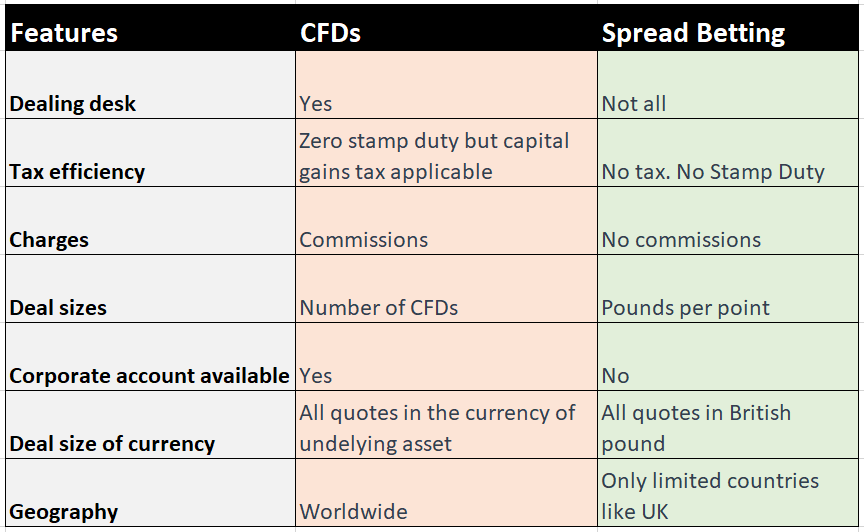

| Features | CFD | Spread betting |

|---|---|---|

| Dealing desk | Nearly all big CFD brokers have a DMA / ECN account for direct market access | Almost all brokers are dealing desk based. No direct market access |

| Tax efficiency | Capital Gains Tax is applicable but Stamp Duty is exempt | No Capital Gains Tax, No Stamp Duty |

| Charges | The commission charged just on the CFD depend on account type. For example, Standard account – Higher spread + No commission. Pro account – Raw Spread + commission | No commissions – just Spread |

| Deal sizes | Number of CFDs | Pounds per decimal point of underlying asset |

| Other Charges | Holding costs might apply | Spread is designed into prices Holding costs might apply |

| Corporate account available | Yes | No |

| Calculating loss and Profit | The difference among your entry and exit value, multiplied by number of CFD, multiplied by the size of the agreement. | The difference among your entry and exit value, multiplied by your stake |

| Deal size of currency | All quotes in the currency of asset on which CFDs is based | All quotes in British pound |

The key difference between CFD trading vs spread betting and is how they’re taxed. Spread betting are free from Capital gains tax, while profits from CFDs can be counterbalanced against losses for tax purposes.

Similarities between CFD trading vs Spread betting

In a number of ways, CFD trading and spread betting are the same.

Market access

With both CFD trading and Spread betting, you can invest in tons of different kinds of market: from shares and stocks to gold, FOREX, Crypto money, ETFs, and options.

Users of both Spread betting and CFD trading can also expect round the clock access to worldwide markets.

Leverage

CFD trading as well as Spread betting are leveraged instruments. It means you can substantially take a position with a small deposit.

You will often be able to buy or sell 1 lot with just 5% margin.

Having said that, the extent of leverage in both CFD trading and spread betting differs amongst brokers.

In my view, derivatives are financial weapons of mass destruction, carrying dangers that, while now latent, are potentially lethal.

— Warren Buffett

Long and Short – both sides of the market

Wit both CFD trading and Spread betting, a trader can take with long or short positions as per his wish. There is no restriction in quantity traded, direction intended. Even short selling is completely allowed.

No ownership of underlying asset

As mentioned earlier as well, with both spread betting and CFD trading, investors don’t own the underlying asset. They just take a bet on the price movement of the underlying asset.

Trading Platform

Almost all UK based brokers provide trading accounts for spread betting as well as CFD trading.

If you compare UK based trading brokers, you will find that the finest financial CFD trading and spread betting platforms are available on mobile apps and desktops.

Short or long term

Any option from spread betting or CFD trading is ideal for both day traders and short term investors. However both are less efficient as a long-term investment due to financing charges and tax purposes.

Just be careful of day trading the market. You can see all your money disappear in minutes. See the following video where a guy lost $1500 in year 2011.

Overnight Holding costs – Financing charges

On most CFD trading and spread betting platforms you will to pay overnight holding charges. The extent and interest rate of these charges depends on the broker.

Stamp duty and other charges

No stamp duty is applicable for both spread betting or CFD trading because you do not take ownership of the underlying assets when you trade either.

A 3 min read about spread betting on BBC news

Top CFD News

I hope you enjoyed reading this article. In subsequent articles in this CFD trading series and spread betting series, I will explain more on all the above-mentioned points and write more on some advanced topics.

Thank you for reading this article. I have written several other such Investment knowledge related articles in other sections on this website.

If you liked this post, kindly comment and like using the comment form below.

Frequently asked Questions (FAQ)

Is CFD better than spread betting?

CFDs are the same as spread betting in a way that you can bet on stock price movement without having to genuinely own the shares. The main difference is that spread bets are considered a type of betting, so are free from stamp duty and capital gains tax.

However, CFDs are only free from stamp duty. For experienced, regular traders in financial markets, contracts for differences are a seemingly popular alternative to spread betting.

Is forex spread betting or CFD?

FOREX spread betting is a kind of spread betting that involves speculating on the value of movement of currency pairs. Spread betting in FOREX involves opening a trade based on whether you think the value of the currency pair is due to fall or rise, resulting in either profit if the market turns in your favour or losses if the market goes opposite to you.

Along with Forex CFD trading, spread betting in Forex is one of the most common ways of FX trading. As mentioned earlier both CFD trading and Spread betting are like financial derivatives (but not in the true sense).

The foreign exchange market is the biggest and most liquid market on the planet, telling us that currency trading is popular with both professional and beginner traders.

Should I start spread betting or CFD trading?

Spread betting is free from Capital Gains Tax while CFD trading is not. Since you do not have the underlying funds when CFD trading, there’s no Stamp duty you need to pay. Which platform you pick should all depend on your personal needs and preference.

If you are looking for an OTC product that is exempt from tax, Spread betting could be the ideal choice for you. Though, if you are looking for a fast access DMA instrument with lowest spreads and prominent tax deduction capabilities, CFD trading might be the smarter option.