A Mutual Fund is an investment vehicle created by combining money collected from several investors to form a pool of funds. Every Mutual fund has a Fund manager – even if it is a passively managed fund.

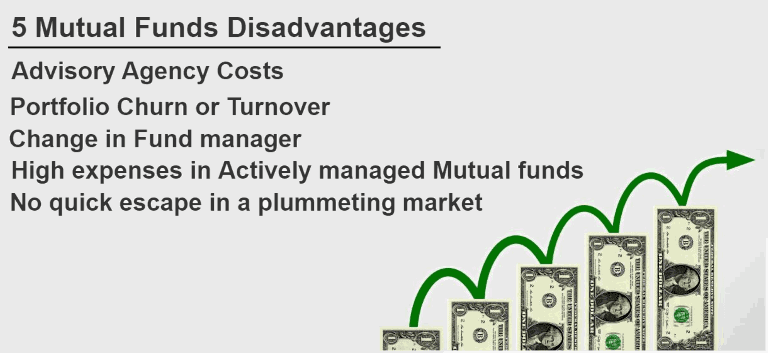

DisAdvantages of Mutual Funds

- Expense related Mutual fund disadvantages include Advisory agency costs, fees and charges due to portfolio churning, heavy charges for Actively managed funds

- Other drawbacks relate to illiquidity, no quick exit option, and impact on performance due to change in fund manager

This fund manager is responsible for putting the fund’s money based on the fund’s investment mission, philosophy and strategy.

A Mutual Fund manager also make the final decisions on which assets will be purchased and/or sold in line with the Mutual Fund theme and long term goal. He would generally purchase assets in appropriate asset classes like stocks, bonds, or commodities.

A Mutual Fund investor participates in a Mutual Fund’s investment pool and profits by being presented with units in the Mutual Fund. The number of units is equivalent to his investment amount.

This article will take you through 5 Mutual Funds disadvantages which are never revealed by Mutual Fund advisors or not presented anywhere in the media.

1. Mutual fund disadvantages – Advisory Agency Costs

One of the most camouflaged disadvantages of Mutual Funds is the Agency Costs. These costs are associated with Agency problems and are relatively common but hidden from MF investors by Mutual fund advisors.

Agency problems are termed as issues that occur where a fund portfolio advisor does not act in the best interests of investors. This could be due to any reason – monetary or otherwise.

Your advisor normally should recommend Mutual Funds based on your risk and return profile and your performance expectations. There are hundreds of Mutual Funds that he can recommend.

If instead of suggesting the fund best suited to your profile, he rather advises on a fund that could be disadvantageous to you but pays him a huge commission, then you are a victim of Agency problem.

People against Advisor incentives say that it gives rise to one of the most common pitfalls of Mutual Funds as an investment vehicle.

The Agency problem gives rise to this conflict of interest. It happens when the financial incentive received by the advisor prevents him from advising you on funds which are rather commensurate with your risk return profile and effectively in your best interest.

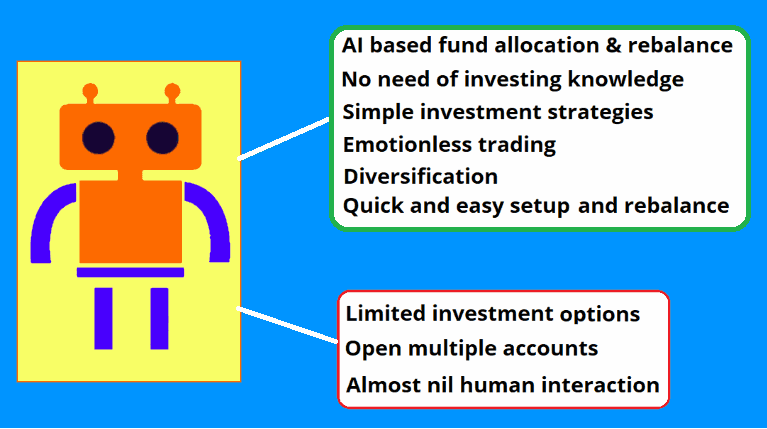

To avoid Agency costs you can look at an automated advisory solution like robo advisor. You may read the following article for details

Advantages of robo advisors. Why robo advisors are bad? Learn Robo advisor Pros and cons. Are Robo advisors profitable? Learn why not to use a robo advisor?

2. Portfolio Churn or Turnover mean extra costs

There are times when a fund manager would try to make a quick buck out of rapid movements in the asset market.

For example, if a specific asset e.g. bitcoin shoots up due to a highly positive news, he would buy that asset only to sell it after a few days or weeks.

The reason is primarily to rope in the possible profit that would be pocketed due to this quick momentum move.

When the momentum cools down, he would sell the asset. This could be after just a few days or weeks. Buying and selling of assets in a portfolio is called churning or turnover.

This frequent churning gives rise to high trading or brokerage brokerage fees and charges. Costs associated with high portfolio turnover are one of the biggest cost specific Mutual Funds disadvantages.

3. Mutual Fund hidden pitfall – Change in Fund manager

The fund manager is the engine of your Mutual Fund. It’s his philosophy, thinking, analysis, and actions that result in high or low performance.

If the fund manager moves on and a new one is assigned to manage your Mutual fund, he will bring his own baggage of analysis, research, and belief and might change the fund’s structure, asset allocation, or some other dimension.

This could result in lower or higher performance. In either case, you will feel a sway in performance compared to what you were used to.

The dependency on the old Fund manager and the lack of him later could be the biggest stumbling block in Mutual funds performance.

The new fund manager might have his own principles and philosophy which might or might not match with your expectations and reasons for your investment in the first place.

Therefore, without any stock-market-specific reason, you will have to take a call on whether you want to stick around or disembark the ship.

On the other hand, sometimes change in Fund manager could also be an advantage of Mutual Funds, depending on the previous manager’s handling of a particular fund.

This limitation of Mutual Funds is generally overlooked because the regulator doesn’t necessitate information revelation at the time of change in Fund manager. How and when will you act, if you don’t know that something unexpected has happened?

4. High expenses in Actively managed Mutual funds

Most passively managed index tracking Mutual Funds come will really low expenses. However, some actively managed Mutual Funds have a downside when it comes to expenses – they charge very high fees.

Expense & fees is one of the biggest actively managed Mutual Funds disadvantages.

Why do actively managed funds charge high fees?

Few reasons why actively managed Mutual Funds charge high fees are:

- They have celebrity fund managers delivering superior returns and thus having higher compensation and bonus

- They have higher portfolio turnover than passively managed index trackers due to frequent buying and selling compared to the trackers.

- They have higher regulatory reporting even though their portfolio composition is reported every 30 days.

- The actively managed fund could also invest in illiquid stocks as per the fund manager’s discretion. Illiquid stocks have higher transaction costs including slippage.

The above mentioned reasons of why actively managed Mutual Funds charge high fees further increase investment expenses and therefore becomes detrimental to growth in Mutual Funds investment performance.

5. No quick escape in a falling market

When the market is gung-ho, we are all happily fully invested in the market. But what is the market reverses and starts sliding down at full speed. Wouldn’t you want to exit at speed of light?

When the ticker starts dropping, you pray to quickly be able to sell your investments to protect yourself from heavy loss.

You can certainly do that with the direct stock or ETF investments. You can exit any direct investments, including options and other derivatives, almost immediately given it is liquid enough.

Whereas with a Mutual Funds, you will have to wait probably till market closing, or possibly till next day opening. One of the biggest Mutual Funds disadvantages is that they impose time restrictions on how and when an investor can place a redemption request.

If you need an investment product where you have the liberty of exiting as and when you wish, then CFDs (contract for difference) are your best bet. Read the following article for more information.

For almost all Mutual funds, the time of the day matters for a redemption request to be accepted during the same day. The Mutual Fund NAV used for calculation of your investment holding value will be based on the structure and rules of that Mutual Fund.

NAV used in this case could probably be current day’s or next day’s one depending on Mutual Fund redemption policies.

However, some illiquid Mutual funds or the ones traded on exchanges but with really low volumes, are the worst offenders in this regard. In this case, you might have to bear a substantial loss.

You might want to read similar articles

Can actively managed funds beat trackers?

Before taking costs into account, an actively managed funds can easily beat trackers. Add the fund management and other charges, and see the balance tilt towards either same sort of returns or a little heavier towards passively managed index tracking Mutual Funds. That is simply because trackers have lower fees and charges.

An average actively managed fund has an expense ratio of around 1.5% a year, while and average index tracking fund charges around 0.3%. Index tracking ETFs charge even less than that – in the range of 0.1%

We can clearly say that due to heavy cost as a crucial disadvantage of Mutual Funds, actively managed funds on an average can possibly never beat trackers.

Top Investment News – CNBC

I hope you enjoyed reading this article. In subsequent articles in this Mutual Funds series, I will explain more on all the above-mentioned points and write more on some advanced topics.

Thank you for reading this article. I have written several other such Investment knowledge related articles in other sections on this website.

If you liked this post, kindly comment and like using the comment form below.