What are Stock market Sectors?

Stock market sectors, also called as industry sectors or economic sectors are distinguishable sets of several group of businesses selling related products or services. All Stock market sectors like defensive and cyclical stock sectors, s&p 500 consumer discretionary etc. are a group of companies falling under same or similar industry groups. It is like a category of stocks. If you can think of stock market as a huge Walmart or Costco store, then a sector is a category in Walmart such as Grocery, Mobile phones, Toys, Furniture. For instance, IT sector is like the laptops, mobiles, accessories and games zone in Walmart. Moreover, FMCG sector comprises grocery and personal care categories.

Dividing an economy into Stock market sectors allows for more in-depth analysis of the economy. Understanding the Stock market sectors and their use & importance in stock selection is called sector based investing and can potentially give you an edge in the market.

Tweet

Furthermore, a Stock market sector can be broken down into several industries. For example, The financial sector can be broken down into banks, asset management companies, life insurance companies, or investment brokerage.

FiveStepGuide may earn an Affiliate Commission if you purchase something through links on this page.

Top 5 defensive and cyclical stock sectors in 2021 for Long-Term Investments

Your investment portfolio should have diversified holdings from different sectors. Before I list down the most profitable stock market sectors for 2021, we should understand that the dynamics and working of the entire world have changed due to Covid-19.

The best defensive and cyclical sectors GICS to invest in 2021 are effectively the beaten down sectors of 2020 after Covid times.

- Communication Services Sector – Work from home is here to stay for long

- Health Care Sector – Vaccination and supplementary medication post Covid-19

- Consumer Staples – everyone has to eat after all!

- Consumer Discretionary Sector – Let’s go shopping… ughhh … online shopping!

- Financials sector – all about $$$: trading in stock market, getting insurance and loans

What are the 11 GICS sectors in US stock market?

According to Global Industry Classification Standard (GICS), the U.S. stock markets is divided into 11 sectors.

- Communication Services

- Consumer Staples

- Health Care

- Financial

- Energy

- Technology Sector

- Consumer Discretionary

- Industrial

- Materials

- Real Estate

- Utilities

Here I will briefly write more on the 5 most profitable stock market sectors after Covid times while providing some info on the list of best stocks from these defensive and cyclical stock sectors for 2021. I am sure you will certainly make money if you follow a sector based investing approach by investing in any of these top stocks from defensive and cyclical GICS sectors. If you believe more in protection of capital than astounding returns, stick to defensive stock sectors. See more below for consumer staples sector outlook in 2021.

Cyclical stock sectors give a boost in your income when the time is right. For example, looking at consumer discretionary sector performance can give you a sense of average growth in all s&p 500 consumer discretionary companies.

Now we look at the top defensive and cyclical stock sectors out of all the 11 GICS sectors of the US stock market

Communication Services Sector

Unlike most depressed sectors of 2020, this was and is still one of the best cyclical stock sectors for 2021. This cyclical GICS sector comprises of companies in the communication services i.e. mobile, radio, internet, vidoe, audio and other twentieth century methods of communication.

Some of the best cyclical stocks from this GICS sector to buy include many multi-billion dollar household names like Verizon, AT&T, T-Mobile, Sprint, Comcast, Charter, Netflix, Facebook, and Google.

Because of the growth in all these companies, Communication Services Sector has been one the top cyclical stock sectors for 2020.

Since work from home is not going home soon, I consider this sector to be amongst the most profitable stock market sectors after covid in 2021

You may like to read similar posts

Healthcare

Healthcare sector is a defensive stock market sector and falls under essential services. Because of its nature of business i.e. providing medicine and treatment when the economy hits a crises, people lose jobs and fall ill, companies in this sector actually make a killing in downturn or recession times!

The companies in these kind of defensive sectors are often good plays and safe bets because people will always need medical care, whether it’s from pharmaceutical drugs or hospital visits. Companies belonging to the healthcare sector are the ones operating in drug & pharmaceuticals, healthcare equipment, healthcare services, Hospitals, Insurance companies, Biomedical companies.

In economic expansion, people generally also focus on spending more on lifestyle drugs, health supplements, workouts, yoga sessions, and even health related travel. This further helps these top defensive stock sectors companies generate multi-billion dollar profits from their other health discretionary line of business.

Due to that, mega names from this sector like Johnson and Johnson, UnitedHealth, Merck, Pfizer have not just managed to survive but also make profits consistently.

Those are the reasons why Healthcare sector is a “defensive” stock market sector and never a depressed or beaten down sectors in 2020 or any year for that matter.

Oevr the last two decades, the health care industry has seen a magnificient increase in technological advancements. Further developments continue to grow each day.

According to Inkwood Consulting report, the global artificial intelligence in healthcare market is estimated to record CAGR of 38.05%, in terms of revenue, during 2020–2028. The market is anticipated to reach a revenue of $59426.79 Million by 2028.

Tweet

Consumer Staples or FMCG (defensive)

Just like the healthcare sector, there’s another name in the defensive stock sectors arena called consumer staples or consumer defensive. Defensive because these companies in consumer staples sector are generally resilient even in an economic downturn. After all, every human being needs food to survive !!

Consumer staples sector or the FMCG sector comprises of food and beverage companies, supermarkets, manufacturers of household goods and personal products.

This defensive stock market sector contains most commonly heard names including Walmart, Costco, Kraft Heinz, Coca-Cola, Procter and Gamble, Estée Lauder, and so forth.

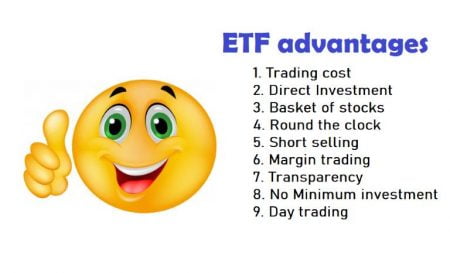

These top consumer staples sector stocks can be purchased any time of the year if you intend to create a defensive ETF portfolio of stocks from any 11 GICS sectors, including this consumer staples sector stocks or any of the most beaten down sectors of 2020.

The consumer staples sector outlook can be gauged from the single reason that people don’t necessarily need to buy new cars, clothes, or eat at restaurants. These products or services are not essential to survival. But they certainly need to buy food arnd household goods.

The key difference between consumer staples and consumer discretionary lies on the distinction between ‘need’ and ‘want’.

Tweet

Companies in Consumer Staples sector produce and/or sell products that people need to survive or also referred to as essential goods. Whereas, companies in Consumer Discretionary sector produce and/or sell products or services that people want to buy, not necessarily need to buy.

The Consumer Staples sector offers a convenient, safe and stable investment option.

Even mega companies in this sector face a lot of competition, thus impacting their profit margins. However, volume compensates for low profit margins here. FMCG companies produce products in huge numbers to serve essential needs of billions of people. This in effect helps in multi-billion dollar profits for them while the profit margin remains low.

However, the consumer staples sector outlook looks bright in 2021 given more people will consume more groceries than probably spend on other lifestyle products.

Consumer Discretionary Sector (Cyclical stock sector)

Following is the smart definition of Consumer Discretionary term from investopedia.

Consumer discretionary is a term for classifying goods and services that are considered non-essential by consumers, but desirable if their available income is sufficient to purchase them.

Companies from Consumer Discretionary sector, also called consumer cyclicals, benefit from a stronger economy. Consumers earn more and spend more on consumer discretionary products while the economy is rising. Some popular multi-billion dollar names from this sector are: Amazon, Home Depot, Ford, Wynn, Starbucks, Target, and Chipotle. Companies in this stock market sector belong to industries such as retailers, apparel, media, restaurants, hotels, autos, and other non-essential household products.

Several Consumer Discretionary sector, ETFs like Vanguard Consumer Discretionary Index Fund ETF (VCR) can be easily added to your portfolio if you want to se growth while playing safe.

These companies have strong quarterly earnings generally in economy expansion phase. On the other hand, when an economy is in contractionary or recession phases, people have lower incomes and thus spend more on products from consumer staples sector.

Financial sector

The financial sector consists of banks, insurance, and real estate companies. It comprises of companies providing commercial and retail customers with financial services. A important portion of companies in Financial sector have their income and profit coming from mortgages and loans. This sector is closely tied with interest rates. If interest rates increase, then big financial institutions make billions of dollars.

The health of any economy is generally dependent upon the financial sector. Better this sector, safer it is for the country. For a stable economy, a healthy financial sector is required since financial companies are providing loans for businesses. This way they expand, grant loans and mortgages, provide investment services to help people build up savings. Insurance companies also fall under Financial sector.

The big names in this sector are JPMorgan, Bank of America, Wells Fargo, U.S. Bank, Goldman Sachs.

Energy Sector

This stock market sector comprises of oil, gas, coal, and fuel companies, and other energy equipment and services companies e.g. oil-drilling equipment manufacturers.

The big names in this sector are Exxon, Shell, Chevron, BP, Schlumberger, Halliburton. Like consumer discretionary sector, this sector thrives on non-essential consumption and therefore the companies in Energy sector generate billions of dollars in profit and give out generous dividends.

However, as expected, this sector is strongly correlated with the price of crude oil. If the price of crude oil is falling, these companies will not able to profit as much from a single barrel of crude oil compared to when crude oil price is touching the skies . Nevertheless, their share price is generally stable, and due to their generous dividends you can easily add them to your long-term portfolio.

Conclusion

There are 11 GICS sectors and tens of sub-sectors in the US stock market. Obviously, I cannot invest or ask you to invest in every sector. The idea behind this article was to give you an introduction to the best defensive and cyclical stock sectors, list down the GICS stock market sectors, and briefly mention the best stocks from defensive stock sectors, cyclical stock sectors, and other beaten down sectors. I am a proponent of sector based investing and try to invest in good companies from both defensive and cyclical stock sectors.

Top Investment News – CNBC

Thank you for reading this article. I have written several other such articles in Investment section on this website.

If you liked this post, kindly comment and like using the comment form below.

Frequently Asked Questions (FAQ)

Which sector is best in stock market? Which sector should I buy now?

There is no definitive answer to that. No sector can be the best forever. The world is changing either subtly or sharply all the time. A stock or sector who’s the hero of the year might be a laggard in next year. In this article I have listed down the defensive and cyclical stock sectors for 2021. If you carefully choose a company n strong growth trajectory or purchase units in an ETF from any of the beaten down sectors of 2020, you will most probably be in profit by end of 2021.

What are the 11 GICS sectors?

According to Global Industry Classification Standard (GICS), the U.S. stock markets is divided into the following 11 sectors in no particular order:

Consumer Discretionary

Consumer Staples

Energy

Materials

Industrials

Information Technology

Telecommunication Services

Health Care

Financials

Utilities

Real Estate

Really nicely explained.

Thanks Amit. Glad to hear that this article was of some use to you.

Question about the Energy sector: Is it Defensive or Cyclical?

MSCI, creator of GICS, puts Energy in the defensive group. I suppose we all need energy in the form of heat in winter and fuel for transportation.

But many other analysts think that it’s obviously cyclical. The rationale I guess is that we need less energy in a stagnant economy, and vice versa.

Which category would you choose if forced to do so?

If some one needs expert view on the topic of blogging then i recommend him/her to pay a

visit this weblog, Keep up the nice work.

Thank you very much for the appreciation. I’m glad you liked the article.

Thanks for finally talking about > Top Beaten Down Sectors 2021.

Cyclical Stock Sectors GICS Vs. Defensive Sectors.

< Loved it!

Thank you very much for the appreciation. I’m glad you liked the article.

It’s amazing designed for me to have a website, which is good designed for my know-how.

thanks admin

Thank you very much for the appreciation. I’m glad you liked the article.

I do not even know how I ended up here, but I thought this post was

good. I do not know who you are but definitely you’re going to a famous blogger if you aren’t already 😉 Cheers!

My spousse andd I stumbled over here different website and thought I shold check things out.

I like what I see so i am just following you. Look forward to exploring your wweb page again.

First off I want to say wonderful blog! I had a quick question which

I’d like to ask if you don’t mind. I was interested to find

out how you center yourself and clear your mind before

writing. I have had a hard time clearing my mind in getting my

ideas out. I truly do take pleasure in writing however it just seems like the first 10 to 15 minutes are lost simply just trying to figure out how to

begin. Any recommendations or hints? Cheers!

I was very happy to uncover this page. I want to to thank

you for your time due to this wonderful read!!

I definitely loved every part of it and I have you bookmarked to look at new things on your

site.

This design is steller! You certainly know how to keep a reader entertained.

Between your wit and your videos, I was almost moved to start my own blog (well, almost…HaHa!) Wonderful job.

I really loved what you had to say, and more than that, how you presented it.

Too cool!

My web page … 황룡카지노

Hi! This is my first visit to your blog! We are

a team of volunteers and starting a new initiative in a community in the same niche.

Your blog provided us useful information to work on. You have done a wonderful job!

Thank you very much. I’m glad you liked the article.

Keep on working, great job!

Thank you very much for the appreciation. I’m glad you liked the article.

I am really inspired together with your writing abilities as neatly

as with the layout for your blog. Is that this a paid subject matter or did you

modify it your self? Either way keep up the nice high quality writing,

it’s rare to see a great blog like this one nowadays..

Thank you very much for the appreciation. I’m glad you liked the article. It takes me few days to write one article. I pen down my thoughts on notepad first, then read those again. Then frame them to a proper sentence. Then for each paragraph, I think again and try to add more information – especially something that is not very well known in google search. I repeat this process multiple times

Hi, i read your blog occasionally and i own a similar one and i was just wondering

if you get a lot of spam feedback? If so how do you stop it,

any plugin or anything you can recommend? I get so much lately it’s driving me insane so any assistance is very much appreciated.

Thanks for reading my blog. I face same problem. I use the standard Akismet Anti-Spam plugin that comes installed in wordpress.