FOMO (fear of missing out), while stock markets are soaring, tops the list of emotions in any investor. Should I invest right now? If I don’t invest now, I will lose those thousands I could earn like my colleague did in the last few months! How could I miss buying Zoom & Tesla stocks when all my friends / colleagues bought it and now have almost $100k profit in their account? I could have become a billionaire just with those stocks!

Do these questions keep popping in your mind now and then? Do you need to start investing but don’t know where and how to start?

This article is classified as the 1st part of the short course in identifying profitable ETFs

Create your own Diversified ETF Portfolio - Introduction

Evaluate an ETF list to build your own Diversified ETF Portfolio example using FundSuperMart fund selector.

Course Provider: Person

Course Provider Name: Jatin Grover

4.5

In this post, I have shown a 5-step guide to identify the most stable ETFs and to show you a Diversified ETF Portfolio example. This post is an introduction to the ETF evaluator tool I created to identify the best available Exchange Traded Funds in the US market with a sample ETF portfolio.

In the follow-up post, I have recommend the best ETFs to invest in 2021 according to my research and investment.

However, I would suggest that instead of directly using recommended funds, you should build your own ETF portfolio. You can follow the method described below to invest in a diversified ETF portfolio.

The next post in this series of creating a Diversified ETF Portfolio providing examples of ETF data websites, sample ETF portfolio examples, and information from multiple other websites.

COPY my ETF portfolio builder tool for skyrocketing profits without much effort. Step-by-step guide with ETF model Portfolio, ETF charts, comparative returns

Apart from direct stock investment, there are 2 popular types of investments for retail investors: Mutual Funds (or Unit Trust) and Exchange Traded Funds (ETFs)

Tweet

Diversified ETF Portfolio example to evaluate stable ETFs

- How to build a Diversified Portfolio of ETFs?

- What are the disadvantages of ETFs?

- Frequently Asked Questions (FAQ)

How to build a Diversified Portfolio of ETFs?

Every investor has at least 2 methods to decide where to invest money (apart from direct stock purchase): guidance from his investment advisor (human or robo advisor), or lots of analysis & research all by himself.

I chose to do some analysis using publicly available data and selected stable growth ETFs for a sample diversified ETF Portfolio. I took many steps to create this ETF evaluator list before I invested in Exchange Traded Funds.

Living in Singapore makes it easy for one to invest both in a developed market e.g. invest in US and in emerging markets e.g. invest in India or invest in China. In Singapore, one gets immense benefits of being able to invest in stocks or invest in ETF of most countries with the least regulatory restrictions.

I couldn’t gather all information for a detailed analysis on a single website to identify the most stable ETFs as well as the worst performing ETFs of 2020. So I surfed a few websites for different parts of my research and compiled them to finalize my list.

You can also read the following post for pros and cons of ETFs in order to decide whether ETFs are right for you or not

10 disadvantages of ETFs along with 7 ETF benefits not publicized or disclosed before investing. ETF NAV vs price. Risks and disadvantages of leveraged ETFs.

Following are the steps I used for my Diversified ETF Portfolio example.

A. Download the entire list of ETFs traded in USA

As the first step for my ETF selector, I downloaded the list of top ETFs from Fundsupermart fund selector in a CSV format.

- Download the initial list as CSV files from both sections of the FSMOne fund selector: Performance & Info tabs.

- Combine the CSVs using MS Excel vlookup function to ensure I do not mix up ETF details.

People living in Singapore are allowed to trade only specific ETFs regulated by Monetary authority of Singapore (MAS). FSM, Interactive Brokers and Saxo markets Singapore have the most comprehensive list of MAS allowed ETF.

Tweet

FSMOne fund selector has an extremely simple interface with an option to download the list of ETFs traded in the US in a CSV format. I use this initial list to “eliminate” the worst ETFs.

Thereafter, I will filter the list based on several criteria using other websites for ETF evaluation of my ETF list. Thereafter I will finalize my list of stable ETFs for a Diversified Portfolio of Exchange Traded Funds, while giving you a flavour of a sample ETF portfolio.

If you go through the entire post, you will see that I have provided examples from many websites, not just Fundsupermart fund selector, Morningstar or Yahoo Finance for statistics such as annualized ETF returns.

In addition, I have shown an example of a website as best ETF evaluator using ETF returns and charts. You just have to provide the ETF investment as a Lump sum purchase or SIP / RSP (Periodic Systematic Investment).

FiveStepGuide may earn an Affiliate Commission if you purchase something through links on this page.

B. Filter & evaluate ETFs on ETF type & age

As the second step to further work on my sample Diversified Portfolio of Exchange Traded Funds, I firstly removed the unwanted columns of information. Following is a screenshot of the original list in MS Excel. Roughly 2250 exchange traded funds as downloaded from Fundsupermart fund selector.

You may select your own preferences to filter down the enormous list for a perfect ETF evaluator. The following are my preferences to build the list of most stable ETFs.

- Remove Leveraged ETFs and inverse ETFs

- Select only USD and HKD as ETF currency

- Remove all ETFs which are less than 1 year old. You can find that out by checking the ETF 1-year return column in the list you downloaded from FSMOne fund selector.

- “Prefer” ETFs which are more than 1 year old.

C. how to select best performing etfs based on Category, Sector, and Geography?

The third step for this ETF selector is to further break down the initial list to serve as the “go-to list” for my Diversified ETF Portfolio example.

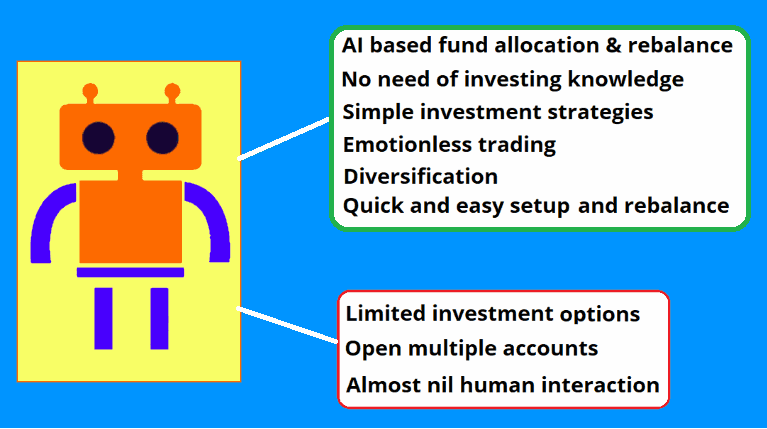

Instead of doing all this by yourself, if you prefer an automated advisory solution like robo advisor that does this automatically for you, you can read the following article.

Advantages of robo advisors. Why robo advisors are bad? Learn Robo advisor Pros and cons. Are Robo advisors profitable? Learn why not to use a robo advisor?

I filtered down the Fundsupermart fund selector list of ETFs based on ETF parameters like ETF returns, category of ETF, geography, ETF sector etc.

This way, I ensure I do not mix up return expectations of an Equity fund in US vs. an Equity ETF in India/China. The same case applies to not mixing up US-Energy ETFs with US-Consumer or US-Technology ETFs.

Since we all know FAANGM was the talk of the town since the beginning of 2020, there’s no point asking stable ETFs like consumer staples ETF to even try to match the 1-year returns of growth ETFs like the US Technology ETF.

To keep yourself up to date on similar topics, FOLLOW ME by clicking the following icons.

1. Select a ETF sector, ETF category and geography combination.

There are roughly 5 categories, 38 sectors and 59 geographies in the initial list (an excerpt below).

I filtered on each and every Category-Sector-Geography mix. Let’s say you make the first combination as the following.

- ETF category = Equity,

- ETF sector = Consumer,

- ETF Geography = US

Following screenshot shows an excerpt from the list I got after filtering for Equity — Consumer funds.

Thereafter, I filtered on Geography and selected US to pick the best US — Consumer funds

Consumer discretionary is a term for classifying goods and services that are considered non-essential by consumers, but desirable if their available income is sufficient to purchase them

Tweet

2. Remove all poor performing ETFs with below average 1 year return.

From the FSMOne fund selector CSV list, I removed all ETFs having 1 year ETF returns falling in the “below average” section. To do this you can use a simple excel filter.

3. Change the geography selection to Global (next one in the list)

Believing in evergreen US consumer staples market and in growing consumer discretionary market is fine but if you really want to leverage on world economic growth as well as diversify away from only US-focused investments, you should also invest in the other large economies’ consumer funds.

My personal belief has always been to diversify with heavier weight on US market, then China/Emerging, then global.

I repeated the steps 1 to 2 for Geography = Global.

4. Lastly, repeat the process for all ETF sector, ETF category and geography combination

I could have chosen to write a simple Excel macro the “below average” ETF returns. However, with this manual exercise I got a feel of the current global ETF market.

Running that step manually helped me to assess ETF portfolio list by glancing at all stable ETFs downloaded from Fundsupermart fund selector. I could actually gauge how different markets and funds perform in reality vs. what I expected based on global news and perceptions.

This way I came up with a narrowed down “better performing” ETFs list for each Category-Sector-Geography permutation.

Expense ratio

Most ETFs offer Dividends and have different expense ratio. To have even clearer differentiation based on 1 year returns, you can add the dividends and subtract the expense ratio from 1 year returns to find the real best ETFs and the actual poor performing ETFs.

This is the best applicable to Fixed Income funds where dividend and expense amount is a substantial part of total annual return. E.g. see the screenshot below for a popular US based Fixed Income fund with returns, dividend, expense amount and effective total 1 year returns.

ETFs generally have low expenses, unlike high costs in a Mutual funds. Transaction cost (brokerage) is the only big cost in ETF, which in most countries is far lower than the cost of Mutual fund purchases.

If you want to invest at low cost for a short term, CFDs (contract for difference) offer really cheap 24-hour trading on same stock market index as tracked by an ETF.

D. ETF selection based on ETF returns, ETF fund size (AUM), ETF risk rating

One-by-one I carefully evaluated each ETF for investment having following expectations.

- 1-year ETF returns > 25% (apart from fixed income ETFs),

- 3-year annualized ETF return of > 15%,

- Best risk-return ratio for lowest possible Risk rating

As an example, lets begin with the first sector and category on the list. I select Category = Alternative Investments, sector = Alternative Investments — Asset Allocation.

Asset Allocation is generally a fancy name for balanced / hybrid funds. Seeking a return of > 25% from an Asset Allocation ETF will be futile.

Tweet

However, the first Asset Allocation fund on the FSMOne fund selector list, NTSX, has a risk rating =10 (yellow highlighted column header).

In my quest to find stable growth ETFs, I therefore don’t think an Asset Allocation ETF is worth looking at. Why? Because using Fundsupermart fund selector, I can find funds with better returns for a risk rating of 10 in other categories/sectors. I have the entire world to invest so why keep my hands tied to Alternative Investments — Asset Allocation.

Moreover, you can do your own asset allocation. Later, in my other article on how to create your own ETF portfolio, I have given some examples of asset allocation and sample ETF portfolios.

The blue text-colored funds in my list are the ones which are less than 3 years old. I have not removed those from my list but have rather colored them blue just to evaluate those Exchange Traded Funds along with other long-running ETFs but with a pinch of salt.

The 2 largest funds in this sector are FV and AOA (2nd and 3rd in the list above). So I text-colored their ETF Name column green to keep an eye.

List of Consumer ETFs

Similarly, now let’s run the ETF evaluator for all ETFs under Category = Equity, sector = Consumer.

Based on my analysis as described above I decided to proceed further with stable ETFs from US (FDIS, VCR, RTH, XRT), 2 from China (CHIQ, CHIS), and 2 from Global (GENY, CARZ).

For my sample diversified ETF portfolio example, I left out ECON from Emerging Markets geography because it has negative / low 3 year and 5 year returns. Even though XLY is possibly the largest fund (based on AUM or fund size) in this sector, I deliberately left it out with the reason being I can select better ETF funds (e.g. FDIS, VCR, RTH) for a risk rating of 10.

I simply make the text under ETF Name column as green-colored for selected ETFs (based mainly on Risk rating vs. returns) for identification in such a huge list. I call this list as “ETF 1.0″

E. How to evaluate an ETF?

In the previous steps, I described how to filter down the ETF list to remove poor performing ETFs. Now that we have a shorter ETF list, I will expand the portfolio ETF evaluator further to make a concrete Diversified ETF Portfolio example and show you the best sample ETF portfolio.

Now, I will show you how to use several other websites apart from FSMOne for fund selection. I will also show you how to get detailed information and ETF statistics not commonly found. I also use my ETF broker’s accounts as well as charts (visual inspection for both individual and comparative plots).

The websites I used for further analysis are etfscreen, etfdb, ETF.com, dqydj.com, markets.ft.com. I also used my accounts with Interactive Brokers & Saxo markets to check ETF parameters, live spread, tradability, regulatory restriction, limit, margin and so on.

1. Start research & analysis with a category+sector+geography combination

Like in the last steps, I start with a category+sector+geography combination e.g. Equity-Consumer-US. Going one-by-one is the best way to deal with lots of ETF data. Otherwise, I wouldn’t be able to astutely create the best diversified ETF portfolio example.

2. Asses ETFs based on important ETF statistics and descriptive metrics

Using the ETF selector, for a chosen combination I carefully evaluated ETF list by:

- Examining following ETF parameters from morningstar.com, markets.FT.com or my interactive brokers account.

- Historical volatility,

- Lipper & Morningstar ratings,

- MSCI ESG Analytics ratings,

- Expense ratio,

- Beta,

- Standard deviation,

- Alpha, and others

- Comparing 3 or 5 year performance of automated periodic investments (SIP / RSP)

- Visually observing their 1y — 5y chart on Fundsupermart fund selector chart center website

This way I get a curated list of ETF to further research & investigate.

3. Ride on ETF relative strength and ETF correlation

Next in this diversified portfolio example, I compare selected ETFs based on relative strength and correlation. The goal is to choose the better ETFs out of a few within same category+sector+geography combination. My plan is to invest for long term (lump sum & periodic investment). No short term trade.

The ETF evaluator is run on at least the following 2 points:

- Prefer ETFs mirroring the best ETFs but with a lower NAV for easy systematic periodic investment

- Prefer ETFs having lower lot size / minimum units to trade, so that I can invest small quantities every week

Volatility in general portrays the ability of the fund to survive financial storms in stock markets. A highly volatile ETF or Mutual Fund or CFD will rocket up and fall abysmally in boom and doom. Due to this, returns would be inefficient in long-term.

4. Sample ETF Portfolio backtesting

Lastly, for a perfect diversified ETF portfolio, before investing, I form a portfolio and backtest it through the following methods:

- Download preferred ETFs’ last 5 years (or since inception if less than 5 years old) daily price data from Yahoo Finance and run excel simulator to generate the best back tested portfolio.

- For a visual check, I plot all my sample ETF portfolios on www.tradingview.com e.g. plot a sample ETF portfolio i.e. a combination of ETFs (e.g. ARKW*2 + VIXM) to see performance over several years.

- Then, repeat the process for every sample ETF portfolio I wish to finally select.

Instead of taking a deep dive here and to rather keep this post simple yet broadly informational, I will further elaborate all this with several examples and links to many useful websites in part II of this series. Click below to access that part II.

COPY my ETF portfolio builder tool for skyrocketing profits without much effort. Step-by-step guide with ETF model Portfolio, ETF charts, comparative returns

ETF drawbacks?

There are many advantages and benefits of ETFs : lower taxes, lower expenses and costs, real-time day trading possibility and many other ETF benefits. However, as good at it sounds, exchange traded funds have a lot of drawbacks as well.The primary disadvantages of exchange traded funds are related to higher volatility, lower liquidity, slippage, withholding tax and a few others.

You may visit my following article on detailed benefits and downsides of ETFs.

10 disadvantages of ETFs along with 7 ETF benefits not publicized or disclosed before investing. ETF NAV vs price. Risks and disadvantages of leveraged ETFs.

Series of posts on creating a portfolio of stable ETFs

This post on diversified ETF portfolio example is part of a series of posts with the sole intention of sharing my knowledge and experience in:

- searching for good quality investment vehicles

- analyzing and researching on choosing between various options from those

- finding an easy, scalable and manageable way to invest in those

- creating and managing my own portfolio while tubing to find a balance between investment expectations, regulatory hurdles and reality

- ensuring the portfolio is in accordance with general asset allocation principles as per my age, investment amount and risk appetite.

Disclaimer: At the time of writing this post, I personally invested in a few ETFs out of the list shown here using trading accounts with Interactive Brokers, and an investing account with Kristal.AI

The same post was first written on Medium.com. Please click here to check out my initial post on medium.

Thanks for reading this post. I have written several other such investment related articles on this website. Please visit the following related posts as shown below.

If you liked this post, kindly comment and like using the comment form below.

Frequently Asked Questions (FAQ)

What are the most important factors in selection of an ETF?

The 3 key points to look for when investing in ETFs are:

– Consistent returns. You can gauge that by looking at ETF returns vs. broader market returns from annual / monthly returns data in various sites like markets.ft.com

– Risk vs. return. Focus on ETFs with low volatility (or standard deviation).

– Fees & charges, especially for non-equity funds. Lower the charges (Expense ratio, fund management charges etc.), better your return.

There are several other factors but the above-mentioned ones are the most important ones.

Should beginners invest in ETFs?

ETFs are “the best” way to invest if you want higher return with lower risk. However, a beginner should try his hands at passive index funds first. This way you will be sure of your funds replicating the current stock market situation and movement. This strategy would also shield you from wild movements in individual stocks. How to start?

1. Read this guide

2. Open an account with your preferred ETF trading broker

3. Deposit only that amount of money, which you can afford to totally loose if the world collapses tomorrow.

4. Make your first trade of preferably 5-10% of your entire capital

5. Observe your position for profit and loss and your account for any extra / untold / hidden fees and charges

6. If all seems fine, then invest more into the same fund but not more than 33% of your total capital.

7. Read this guide again. Look at other investment opportunities to profit more at lesser risk. This is called diversification

What are some Characteristics of index tracking ETFs?

Index tracking ETFs or also called Index funds are passively managed ETFs. The ETF fund managers do not focus on outperforming the underlying index. The benefits of Index tracking ETFs are that they charge mush lesser fees than actively managed ETFs.

But one loophole or disadvantages of ETFs, specifically index tracking ETFs, is that a ETF fund manager or ETF asset management company creates a proprietary index being created just for purpose of calling the ETF as an index tracking ETF.

For example if you look at the ETF “SPDR Kensho Clean Power ETF (CNRG)“, you will notice it tracks “S&P Kensho Clean Power TR USD” index, not the more common The S&P Global Clean Energy Index. Why? Now you have the answer. This is one of the biggest drawbacks of index tracking ETFs.

1 thought on “2021 Diversified ETF Portfolio example | Best Stable ETFs | ETF evaluator<p class='sub-heading'>Do it yourself ETF portfolio</p>”