A Mutual Fund is a pool of funds (money) gathered from several investors. Almost every Mutual fund is run and managed by a Fund manager. He invests the fund’s money in different assets like stocks, bonds, or commodities, and might hedge his holding using options. An investor then gets a share in the Mutual fund as per his invested amount.

These fund managers create the fundc’s investment mission, philosophy & strategy. They also make the final decisions on which assets will be purchased and/or sold in line with the Mutual Fund theme and long term goal.

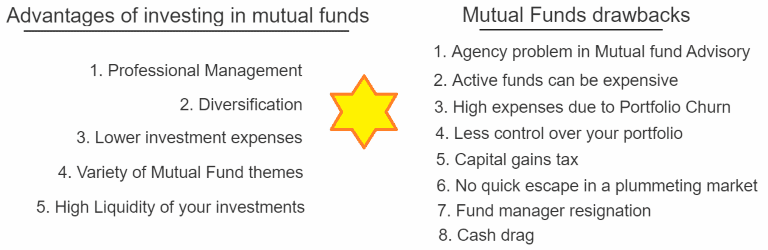

In the following few paragraphs, let me tell you about several advantages of Mutual Funds as well as Mutual Funds disadvantages not commonly known.

Key benefits and limitations of Mutual Funds

- Advantages of Mutual Funds include getting access to Professional Management, Quick & Easy Diversification, lower investment expenses, high investment Liquidity,

- Mutual Funds disadvantages and limitations include high expense due to Churn, Agency problem in advisory, less control over your portfolio, tax issues, hidden fees, no fire exit in plummeting market, fund manager dismissal

The Fund management company hires experts in human psychology. They very well understand general crowd’s perception of advantages and disadvantages of investing in Mutual Funds. They obviously know all the Mutual Funds pros and cons more than any common investor.

Advantages of Mutual Funds

1. Professional Management

Amongst the several Mutual Funds pros and cons listed here, this is the most prominent advantage of Mutual Funds. Most Mutual Funds are actively managed by a professional human fund manager. Its very different from your funds being managed by a passive Robo advisor.

The core difference between active and passive Mutual Funds is that in active management, the fund manager selects underlying assets based on his own analysis and judgment.

Whereas in passive fund management, the fund just tracks some market index. The fund manager tries to replicate the performance of the tracked index by buying exactly same amount and weightage of stock as that in the followed index.

More about active versus passive fund management is given in the following investopedia article:

Investopedia: active versus passive portfolio management

Since most Mutual Funds are actively managed by a fund manager, the biggest blessing of a Mutual fund is that you need not worry about rebalancing your portfolio (purchasing or selling shares) at the appropriate time.

The fund manager handles all that for you – one of the most loved advantages of investing with Mutual Funds.

2. Diversification

If you carefully look at all advantages of Mutual funds, you will notice that one huge benefit of investing in Mutual Funds is reaping the fruits of diversification with just a little effort.

As an investor looking for consistent stable returns, you should certainly diversify your portfolio across various asset classes, and securities. This helps reduce the peril of a stock market crash.

A well diversified portfolio will be able to handle sudden tumbling down of your investment value since the investment is spread across various securities and asset classes, which all react differently to movements in stock market.

The diversification favoring point in Mutual Funds pros and cons is that in order to create a diverse portfolio yourself without Mutual funds, you would need to purchase dozens of bonds and stocks.

You will also need to accumulate those based on the weightage assigned to each based on your own thoughts on market direction, future growth of the asset, while ensuring your portfolio is well diversified.

However, with just one mutual fund, you can diversify your portfolio across hundreds of securities. The convenience of Mutual Funds for diversification is that they offer you the ease of spreading your investment over hundreds of securities.

For example, if you buy an index tracking mutual fund, you can immediately diversify across all the securities tracked in that index.

3. Lower investment expenses

The most publicized benefit amongst all Mutual Funds pros and cons is that they are one of the lowest cost methods to invest in a portfolio of securities. A retail investor (investor; not trader!!) generally executes 1 trade in a week on average with an amount comparable to his/her income.

If a Mutual Fund on the other hand executes the same trade at the same time but on behalf of thousands of investors, its brokerage and other trading charges will roughly be reduced by one-thousandth!

This point undoubtedly depicts the best advantage of Mutual Funds if you talk about savings on investment fees and charges. Most Mutual Funds have relatively low expenses and very low minimum purchase or minimum balance requirements.

This is another big reason why Mutual Funds are attractive to investors who are seeking low-cost investments – another huge advantage of investing in Mutual Funds

4. Variety of Mutual Fund themes

If you are interested in investing in a particular sector, there are tens if not hundreds of stocks available for you. If you list down Mutual Funds pros and cons, you will notice that even for an obscure sector, there are tons of Mutual Funds out there.

Each one has its own investment theme and mission. In today’s world, it is almost impossible for an investor to not be able to find at least one Mutual Fund suiting his liking or preference.

The freedom to choose a specific stock to invest might be a restriction but the biggest merits of Mutual Funds lie in the choice available via investing in the Mutual Funds universe.

5. High Liquidity of your investments

If you need urgent cash, you can sell shares in Mutual Funds easily without worrying about loss due to lower liquidity and trading slippage. During the day, the Mutual fund system would deduct the units allotted to you and would assign same units to a new buyer.

Along with other cost advantages of Mutual Funds, this privilege of high investment liquidity has the added benefit of zero transaction costs. This is how you get an edge in investing with Mutual Funds.

This way, Mutual funds are a boon to investors seeking investments in small cap stocks or illiquid fixed income instruments.

Mutual Funds drawbacks

Mutual Funds are really not as flowery as they are shown. Let me take you through certain disadvantages of Mutual funds.

1. Agency problem in Mutual fund Advisory

Agency problems are common between trustees and beneficiaries, or Mutual fund advisor and investors. Agency problems occur when a fund manager does not act in the best interests of investors due to any reason – monetary or otherwise.

A Mutual fund advisor generally advises you based on your profile, performance expectations, and risk appetite. He can offer you one or few out of several Mutual Funds available. However, due to greed, the advisor might advise you only on the funds that pay him a big commission.

Agency problem is also a big debate in Mutual Funds pros & cons. The people against advisor commissions say that it gives rise to one of the most common drawbacks of Mutual Funds.

A conflict of interests arises when the financial incentive offered to the advisor by the Mutual fund management company prevents the advisor from advising the client for client’s best interest.

This conflict of interest is called an agency problem and is really common in Mutual fund advisory business, especially in developing markets.

2. Actively managed funds can be expensive

Most Mutual Funds come will low expenses. However, some actively managed Mutual Funds have a downside when it comes to expenses – they charge very high fees.

The cost factor is one of the biggest decisive factors resulting in a heated debate amongst proponents of Mutual Funds advantages and disadvantages.

According to the difference between active and passive Mutual funds, a fund manager claims all responsibility and compensation for a profit or loss making fund. The actively managed fund could also invest in low liquidity stocks as per the fund manager’s discretion.

This further increases trading expenses and therefore becomes detrimental to growth in Mutual Funds investments.

3. High expenses due to Portfolio Churn

A fund manager may try to make quick bucks out of high volume or news-based movements in the stock market. He might be of the opinion that a specific stock might shoot up due to a forthcoming news and would buy that stock for a short term.

He would then sell the stock a few days after the news is released in public. This buying and selling is called portfolio churn or portfolio turnover.

High portfolio turnover is one of the most uncommon pitfalls in Mutual Funds, resulting in higher trading expenses for more than 10% of all actively managed Mutual funds worldwide.

4. Less control over your portfolio

If you invest in Mutual funds, you are relying on the fund manager’s discretion to build a portfolio. The biggest weakness of Mutual Funds is that you cannot invest in a specific sector or stock unless you purchase shares in a sector specific Mutual Fund. The fund manager of a sector specific Mutual Funds purchases securities from that particular stock market sector only.

The superior control of your investments is something missing in Mutual Funds. If you talk about Mutual Funds pros and cons, the investors who love the power of managing their own finances would really dislike Mutual Funds for just this one thing.

5. Capital gains tax

Whenever one sells any investment for profit, one has to pay capital gains taxes. With your own self-purchased investments in individual securities, you can time the exit trade and therefore calculate and control the tax burden.

One of the biggest tax related disadvantages of Mutual Funds is that they lack severely in being tax-efficient.

Mutual funds, on the other hand, exit an investment based on fund manager’s discretion, offering you – a Mutual Fund investor – less control over when you pay capital gains taxes.

6. No quick escape in a plummeting market

If the market starts falling, you can immediately sell your investments to protect yourself from further loss. However, Mutual Funds have certain time restrictions on how and when an investor can place a redemption request.

In most Mutual funds, if a redemption request is received before a particular time, the applicable NAV of current day or next day is used to price the exit value.

However, some Mutual funds, especially closed ended ones, are the worst Mutual Funds in this regard – they calculate their NAV just once every week. Imagine, the market starts sliding down rapidly, and you immediately send your redemption request, either offline or online.

But the exit value of your holdings will come after few days. In this case, you might have to bear a substantial loss.

7. Fund manager resignation

Your fund performs well or worse based on your fund manager’s investment philosophy. You obviously would have started your investment in the best performing fund. What if after some time, the popular & profit-generating fund manager moves on and a new one is assigned to manage this Mutual fund.

The dependency on Fund manager and the lack of him later could be the biggest stumbling block in Mutual fund performance.

The new fund manager might have his own principles and philosophy which might or might not match with your expectations and reasons for your investment in the first place. Therefore, without any stock-market-specific reason, you will have to take a call on whether you want to stick around or disembark the ship.

This downside of Mutual Funds is generally overlooked because of no media coverage on Fund manager’s position over the years.

8. Cash drag

Mutual funds have to keep some money on hand to transfer money to investors redeeming their investments. The fund manager could also, for some other reason, sell underlying assets resulting in spare cash.

This in turn becomes a huge disadvantage of Mutual Funds when it comes to financial performance. This cash does not earn significant return and can have a little impact on your returns when compared to 100 percent of your money invested in the market.

Top Investment News – CNBC

I hope you enjoyed reading this article. In subsequent articles in this Mutual Funds series, I will explain more on all the above-mentioned points and write more on some advanced topics.

Thank you for reading this article. I have written several other such Investment knowledge related articles in other sections on this website.

If you liked this post, kindly comment and like using the comment form below.