A Robo advisor is a tool uses Artificial intelligence based technology to select investment options based on certain questionnaire about the investor’s trading personality. A Robo-advisor collects information from investors about their return expectations, risk appetite, and their current financial situation. It then runs an AI based algorithm to recommend investing vehicles like ETFs, mutual funds and other securities.

You can think of Robo Advisors as investment advisors that provide guidance for your investment but with reduced charges.

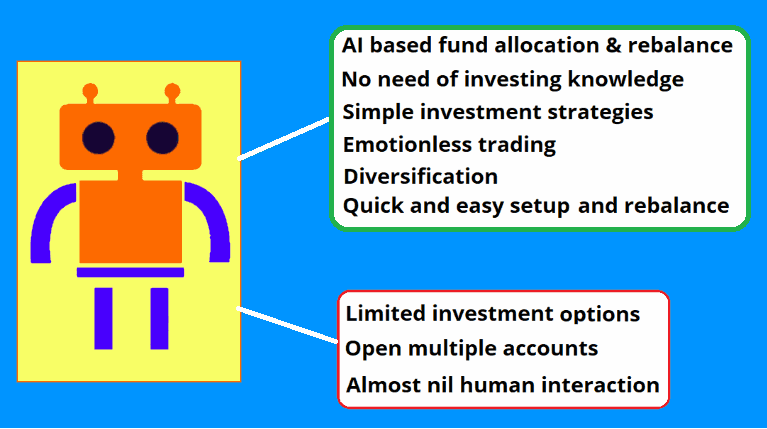

Now, let’s look at the Robo advisor pros and cons in detail.

Robo Advisor pros and cons:

- Advantages of robo advisors include getting access to AI based fund allocation & rebalance, zero investing knowledge needed, simple investment strategies, optimal diversification, emotionless trading.

- Robo advisors disadvantages include limited investment options, high fees due to churn, less control over your portfolio, nil human inte I will fix it later I saidraction

You can read this wikipedia article to know more about Robo Advisors.

Advantages of Robo Advisors

An investor using robo advisor as an investment vehicle has the following advantages.

1. AI based fund allocation & rebalance

Let’s begin by answering following question to make it more clear.

How does robo advisor work?

Every robo advisor begins with asking you to open an account and fill up a questionnaire to define your risk profile. The questionnaire is not read by a human but by an artificial intelligence based algorithm.

The questions in the questionnaire are framed to help figure out your psychology in investing. The idea is to extract your behavior, return expectations, risk appetite, and preference toward certain asset classes.

To determine Robo advisor pros and cons properly, we need to look at how it works? The algorithm then recommends certain instruments to add to your portfolio. One advantage of robo advisor lies in the choice of executing all investments.

If you don’t want to manually select few instruments out of those suggested ones and buy, you have the option of leaving everything to the algorithm. Using your trading account details, it will buy those instruments it suggested to you in the first place.

Now you can see that the one big advantage of robo advisors is expert advice and superior execution from an advanced AI based algorithm.

The AI based algorithm will also keep monitoring the market for any major bumps & turns and will advise you to buy or sell based on any further market moments the AI algorithm predicts.

2. No need of investing knowledge

The advantage of using Robo advisors is that they can be the best choice for beginner investors who have not yet developed the financial expertise or experience required to make informed investing decisions.

Reason being, the robo in the Robo advisor will invest your money and rebalance your portfolio based on your preference, your risk appetite, market timing, economic cycle and a lot more

If you talk about Robo advisor pros and cons, you will realise that by using Robo Advisors, you escape the effort needed to gain investment knowledge.

3. Simple investment strategies

Robo advisors generally do not invest in complex strategies. Instead, they utilize computational power to come up with recommendations for your portfolio. Let’s see how Robo advisors have this advantage of using simple investment strategies to make you rich.

Can robo advisors make you rich?

Robo advisors can make you rich and help you truck loads of money, given you pump in a lot of capital and are open to working with different kinds of strategies. They often utilize a very simple investment strategy, such as an asset allocation strategy to invest 60 percent in stocks and remaining in bonds.

The AI-based robo advisor has its advantages of suggesting some investment securities. However, if you carefully see, even the most aggressive portfolios comprise of low volatility, ETFs securities and Mutual funds. This is to ensure that your Investments are safe even in times of Market turmoil.

Since you won’t have various assets to track, you will be able to easily and rapidly assess Robo advisor performance vs Mutual Funds returns.

4. Emotionless trading

In the world of trading this advantage of a Robo Advisor is far more beneficial than all cons combined. Since you do not have to make any final decisions on selection of Securities and then finally trading those, you are free from seeing your emotions come in the way of your investing decisions.

Investing with a robo advisor is advantageous in the way that it will give you a suggestion and the very start of your purchase. When you open the account or when there is time to rebalance based on Market movement it will give you a signal or alert.

You can then configure the robo advisor in at least 2 ways: the first one is to just give advice, while the second one is to actually go and buy or sell securities on your behalf.

If you start counting the Robo advisor pros and cons from here onwards, you will easily agree that a Robo advisor is far easy and helpful since it has no emotions and so will execute all orders simply based on the strategies.

5. Diversification

Diversification is the process of allocating capital in a way that reduces the exposure to any one particular asset or risk.

Wikipedia

Compared to any individual asset or security, a well diversified portfolio comprising of different assets classes on an average is bound to give better returns in the long-term term. It will also certainly have lower volatility and therefore lower risk.

Other huge computational power & speed related advantages of Robo advisor are about the access to a plethora of underlying assets.

Let’s answer the following question to know more about diversification.

How effective are robo advisors?

The core benefit you get from a Robo Advisor is regarding the most optimal diversification. As a human you might not have the time or spend all the tools to analyze and research thousands of Securities, mutual funds, ETFs traded in your regional market or globally.

So when you do manual research, you look at only tens or maybe hundreds of Securities, Mutual funds or ETFs and decide to invest in the best possible ones. A Robo Advisor helps you by using its computational power and AI research to analyze thousands or millions of securities.

Evaluation of Robo advisor pros and cons depends on the final outcome of your investment. With such an intense research, you are bound to easily create the best possible diversified portfolio in line with your risk-return profile.

6. Quick and easy setup and rebalance

Working adults generally don’t not have the time to actively manage their investments. So they should have an option to put their portfolio on some automated mode.

After an account is opened with a Robo advisor, all automated payments and regular periodic investments have to be setup.

Subsequently, the investor need not do anything else to run his investment portfolio, until and unless he wishes to close the account or withdraw funds fully or partially.

This is clearly a brilliant benefit of Robo advisors with regards to account setup. Almost all accounts can be opened with minimal documentation.

Now, we will look at the disadvantages of Robo advisors.

Robo advisors disadvantages

I will discuss a few robo advisors disadvantages and will explain you why some people perceive robo-advisors as bad.

1. Limited investment options

Amongst all the pros and cons of Robo advisor, one of the most talked about Robo advisor disadvantages is the options it provides to investors. If you have knowledge, experience, and expertise in stock selection, and have some ideas about a specific stock you wish to invest in, you probably would want to make your own investment portfolio.

However, in case of a Robo advisor, you don’t have any option to direct it to purchase your preferred stock. The options provided by Robo advisors are in general based on the questionnaire it presents to you before you start making any investments.

For example, one of the questions could be: Do you prefer a 25% gain with chances of a loss in portfolio, or a 8% gain with stable growth?

This would not appeal to investors who wish to actively make final decisions regarding their money & investments.

2. Forced to open multiple accounts

If a person does not want to invest in a specific stock which is in the themed portfolio of a particular robo advisor investment plan, he/she will need to open a separate brokerage account. A few investors might also need to combine 401 (k) with other investment accounts.

In this case, the automation benefit provided by even the best Robo advisors for beginners is far less suitable.

3. Almost nil human communication

Some Robo advisors provide real time assistance over chat or phone, but this normally comes with additional cost. Most customer service agents or behind the scenes advisors interact with you exclusively through the web.

The trade-off is that the fees of Robo advisors are much lower than most financial advisors.

However, if you prefer speaking to a real human, or if you would want to be hand-held perhaps for website or software interface training, then a human advisory service would be much better than a robo advisor

Concluding all points in Robo Advisor pros and cons

One advantage of Robo advisors is for people who simply want to fund an investment plan with low charges. They will be really happy with a Robo Advisor service.

On the other hand, a drawback of Robo advisors is that it’s performance can sometimes be inferior to your own investment portfolio built with direct stock investment.

Top Investment News – CNBC

I hope you enjoyed reading this article. In subsequent articles in this Robo advisor series, I will explain more on all the above-mentioned points and write more on some advanced topics.

Thank you for reading this article. I have written several other such Investment knowledge related articles in other sections on this website.

If you liked this post, kindly comment and like using the comment form below.

Frequently Asked Questions (FAQ)

Are Robo advisors profitable?

Artificial intelligence and machine learning tools have made a huge impact in the financial market. Financial organizations regularly use automated tools to protect identities, check credit, assess risk-free markets, and make payment transfers more secure.

Robo Advisors use these latest technologies for quick investment decisions, price or quote check & comparison. They utilise this prowess to fill quotes in less than a microsecond. According to US News, Robo Advisors manage more than 223 Billion USD in total funds and that number is expected to jump to over 380 Billion USD by 2022.

As Robo Advisors gain more attention, institutions and investors wonder just how remarkably these platforms work and whether they are as profitable as Mutual Funds and other human-managed investments.

Can Robo Advisors beat the market?

Since Robo advisors normally invest in index funds, there is virtually no chance that you would generally be able to beat the market. And since they also diversify your holdings with bonds and other fixed-income assets, you will normally underperform the stock market during bull runs.

Most of the Robo Advisors will not beat the market because they invest in a proper passive index strategy that tries to replicate the market rather than incorporate any alpha approach that would potentially beat the market.