CFD trading meaning

- CFD is a leveraged financial instrument which mimics price movement of an underlying asset.

- CFD has benefits like low costs, no stamp duty, Direct market access, 24hrs dealing, profit tax offset by losses

- CFD costs include commissions, overnight holding interest, and spreads

CFD contract for difference definition

A Contract For Differences or frequently referred to as CFDs is a financial product which helps a trader profit from price movements of the underlying asset.

The asset can be a Stock index, a stock, commodity, forex or any other instrument commonly traded on exchanges.

Here’s a really simple yet useful tutorial on CFD stock trading that will get you up and running very quickly if you’re new to CFD trading. By the time you finish this article, you’ll get to know

- how do CFDs work?

- what are CFD contract specifications?

- is cfd trading profitable?

- what are the costs involved in CFD trading?

How do CFDs work?

A CFD is kind of a derivative product which derives its value from that underlying asset. CFD trading means trading a financial instrument which generally rises and falls in tandem with the underlying asset.

All CFDs derive their value as a result of the change in price of that underlying instrument.

CFD trading uses leverage and hence this financial instrument should be used with caution by beginners.

To give you a CFD trading example, let’s say you buy a CFD on Amazon with current market price of $2260.00. Let’s say the price rises to $2270.

Your profit from that change in price then will be equal to $10 for every unit of CFD.

So if you bought 800 units of the CFDs, then your profit is $800 x $10 = $8000. This shows how the value of the CFDs mimics the underlying stock prices, and how you can profit on this change in price.

So, we just saw practical example and benefits of CFD stock trading. We learnt that the Contract For Differences is simply an agreement between two parties to exchange the difference between the opening price and the closing price of an underlying.

If we talk about share CFD trading, then the underlying is a stock. Once the contract is completed (you close the opened position), this difference is multiplied by the number of shares specified in the open contract.

CFD trading uses this basic principle to make leveraged profits in asset market movements.

It is estimated that nearly 20% of the UK equity market turnover is based on CFD paper contracts compared to actual equity purchase and sale.

This means no transfer of share ownership takes place in 20% of the share CFD trading cases.

Long and Short in CFD trading

When traders open a CFD trade they have the option to either open a long or a short position.

A long position is when the trader buys into the trade hoping shares to go up.

A short position is when the trader sells to enter the trade hoping the shares will fall in price.

A trader who has gone long into a trade will profit as the value of the underlying share increases. Conversely a CFD trader who has initiated a short will profit upon a fall in the underlying share.

A long CFD contract gives the trader no rights to acquire the underlying share in CFD stock trading. He holds no shareholder rights but receives the dividends as well as the capital returns.

A short CFD trade gives the CFD trader the profit for the falling shares but there is no contract requirement to deliver the underlying shares at any point.

Read more about long or short positions in Options:

Key CFD contract specifications

Contract value

The contract value of a CFD is defined as the number of shares the CFD trader has assigned for the trade multiplied by the price of the underlying share from which the value of the CFD is derived.

This key component of CFD contract specifications defines how much you might gain or loose on price movement of the underlying instrument.

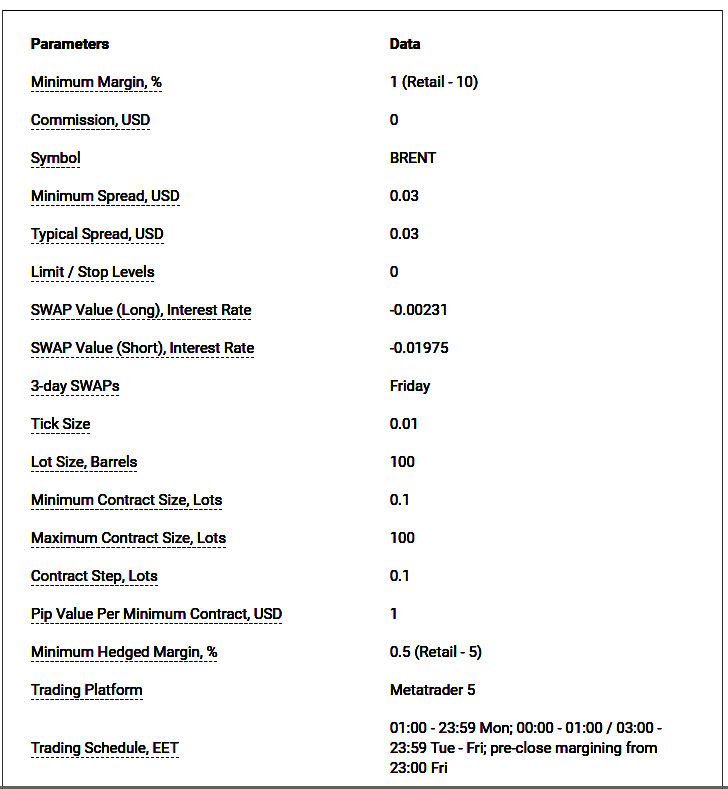

Minimum margin

In CFD stock trading, if a CFD trader opens a position with his CFD provider, he is not obligated to pay the full underlying value of the contract.

The only money that is required to open a share CFD trade is the deposit funds also known as the trading margin or collateral.

The margin you put up to open a trade depends on the CFD provider you choose as well as the liquidity of the underlying share.

The level of margin is usually given as a percentage. This essential component of CFD contract specifications defines your leverage.

The CFDs are usually marked to market daily which means the CFD trader needs to ensure that the level of margin in their account every day matches with any changes in price of the underlying share.

Swap interest or Swap value

Traders would also pay daily swap interest on the full value of a long CFD trade since the provider has essentially financed the value of the trade. Conversely on short trades the trader would receive interest.

These interest payments will also include a percentage fee for the CFD provider. So in long positions you may add two to three percent on top of the set interest rate and for short positions you would subtract that interest margin from the cash rate of the day.

Minimum lot size

It is the minimum lots required to initiate a trade. Generally it depends on your CFD stock trading account type.

A standard account has a Minimum lot size of $100,000 for Forex CFDs while a micro account has a Minimum lot size of $1000 for Forex CFDs

Its similar for commodities and stock CFD trading. Minimum lot size can vary from 0.01 standard lot to 1 full standard lot depending on various factors as described in your account opening form with the CFD trading provider.

Brief history of Share CFD trading

CFDs were mainly used by non market makers to short a stock in the 1990s in UK equity market. Before this push for CFD stock trading by non market makers, only the market makers, like large investment banks, were able to short stocks.

The reason for popularity of share CFD trading was mainly because they were a brilliant instrument to offset the loss from long positions in stocks. A Trader in an institution would easily pay very small margin to acquire a counter short position.

There was no need to borrow the stock. This reduced the CFD trading costs further. There were no real securities exchanged, and therefore there were no exchange charges and taxes to be paid.

The users of this new CFD stock trading system managed by the investment banks were typically the hedge funds, arbitrageurs, as well as other funds utilizing neutral market strategies.

Somewhere around 1996, this CFD share trading revolution started in UK, which further spread to Australia by 2002.

Is CFD trading profitable?

Most of the successful CFD traders having several years of experience earn a maximum of just about 40% if all their CFD trades are in profit. This profit is further reduced because of the CFD trading costs as described above.

CFD trading providers are required by law to notify retail traders about the percentage of Retail Clients who lost money trading CFDs with them during the last 12 months.

You will see this notice somewhere on every CFD stock trading providers website.

You may wish to read similar articles

CFD stock trading benefits

Over the last decade, CFD trading has been gaining in popularity for its flexibility and features. CFD stock trading has been used for a number of years now but the trading was largely restricted to large institutions initially.

Recently the scope for CFD trading has been expanded to include retail traders with a huge reduction in CFD trading costs.

This enabled the small private trader to participate in trading the performance of a stock without owning the actual equity.

No stamp duty on CFD stock trading is needed to be paid because no real transfer of stock ownership takes place. And as no actual change of ownership takes place, the trader does not have any ownership rights such as the right to vote. No stamp Duty also helped reduce CFD training costs.

But on the other hand CFDs expose the trader to the real time performance of a stock price including dividends and corporate actions.

With the use of margin facility, CFD trading has revolutionized the personal share trading industry by allowing traders to enter into a trade without putting up full capital into the investment.

Margin or leverage doesn’t have any direct effect on CFD trading costs but has an indirect effect on absolute $$ profit that you can make by putting only a small sum of money at stake.

CFD trading has allowed traders to have a low cost exposure to equity price movements which is especially important for the traders bottom line.

Depending on which country you are in, CFD stock trading generally attracts no stamp duty, STT or other types of taxes. As mentioned earlier, the CFD Trading costs are reduced or increased based on taxes and duties.

These unique CFD features are attractive advantages for traders who make a living from CFD trading.

Now when traders enter into a CFD trade, most CFD stock trading provider firms choose to hedge their position directly into the underlying market for all CFD trading transactions.

This feature may or not be one of the important points in choosing a CFD stock trading provider, as some of them may not hedge all positions.

It is your decision whether you wish to risk having a CFD trading provider that hedges every trade or simply a CFD stock trading provider that hedges some trades.

For those providers that directly hedge all their trades, CFD trading liquidity is almost always a reflection of the actual liquidity of the CFD’s underlying stock in its marketplace.

But with the latest technology used in CFD stock trading, that is not a problem because almost all CFD stock trading transactions now are instantaneous.

CFD trading costs

An important note on CFD stock trading costs. There are 2 main costs in CFD trading. Let’s have a closer look now at each of them:

1. Commission on CFD trades

With some CFD providers, there is in fact no commission. This also greatly increases the profitability of your CFD trading systems, as well as the fact that you can benefit hugely from the leverage.

Then the next question you may ask is how do CFD providers make money?

CFD spread explained

They make money by charging you the spread between buy and sell. A spread is the difference between the buy and sell price of the CFD as quoted on the CFD provider’s trading screen.

For most of the popular CFD providers, the CFD trading costs are abysmally low or zero.

With other CFD providers, there may be a commission of say 0.15% of the trade size or $15, whichever is greater, each way.

These CFD trading costs are similar or less than the commission associated with stock trading, especially when you consider that the multiplied profits that the leverage gives you.

2. Interest charges or holding cost

With CFDs, there’s interest charged for long positions that are held overnight. For short positions, the interest is paid to you.

The amount of interest charged is usually a reference rate plus approximately 2%, and the interest paid is usually the same reference rate minus approximately 2%. And the reference rate is usually a major bank’s overnight interest rate.

Traders would also pay daily swap interest on the full value of a long CFD trade since the provider has essentially financed the value of the trade. Conversely on short trades the trader would receive interest.

For example, the interest rate charged for overnight held long positions may be 7.5% or 0.075 per annum. To calculate how much this CFD trading costs us for one trade, we need to make it “pro rata”.

That is, we’d need to divide the 0.075 by 365, multiply it buy the number of days in trade, then multiply it by the trade size. For example, for a trade size of $10 000, held for 14 days, the interest cost is about $28.

That’s doesn’t seem to be be a huge cost for a holding period of a few days. For a short trade, the interest is paid to you, so will offset the CFD trading costs rather than contribute to it.

Top CFD News

I hope you enjoyed reading this article. In subsequent articles in this CFD trading series, I will explain more on all the above-mentioned points and write more on some advanced topics.

Thank you for reading this article. I have written several other such Investment knowledge related articles in other sections on this website.

If you liked this post, kindly comment and like using the comment form below.