May I suppose that if you are reading this, it means you are looking for a way to make huge profit from your investments. Why do investors flock in on the idea of Options trading? Is it the temptation of seeing your friends make windfall profits in 2020 stock market boom due to Covid-19?

What if I tell you that there is a way to get in a stock at some price and wait till it rockets up. Once it does, you might see up to 1000% profits in just a couple of days. Read further if you want to how it works — profit from a stock without having to purchase it!

Options Trading for beginners – Contents

In this article, you will find details on Options trading for beginners – a definitive guide to trade options profitably.

It is like a Fundamental Options trading tutorial that will cover basics of options trading for beginners, some basic options terminology, and 4 types of vanilla options strategies for beginners.

What’s coming up next: In this Options trading tutorial, I have further explained basics of Options Trading for beginners with examples.

- options basics & options terminology,

- how to start trading options,

- how to choose an options broker,

- how to trade options strategies for beginners,

- how to pick the correct options strike price and maturity,

- how to open an Options trade, and

- how and when to close a trade.

This 5000+ words article is an ultimate guide on fundamentals of Options trading for beginners describing all different steps needed to help you learn options trading basics.

What is an Option?

An Option gives the buyer the right, but not the obligation, to buy or sell the underlying asset at a specific price on or before an agreed date.

In simple words, an option buyer pays a premium to a seller to buy an underlying asset after a defined period of time at a price agreed on the date of purchase.

However, note that the buyer of the option is NOT obligated to buy or sell the underlying asset.

The Option premium is paid upfront. When the buyer decides to exercise his right of buying the underlying asset, he will have to pay the rest of the money.

Options are derivatives because they derive their value from an underlying asset. An instrument whose price moves in some relation with an “underlying asset” is called a derivative.

Prices of derivatives such as Futures and Options depend on prices of their underlying instruments. For example, Bitcoin futures price mimics Bitcoin’s price movement all the time.

And I suggest all beginners should approach Options trading as a career, and be careful of not making it a cool side hustle.

FiveStepGuide may earn an Affiliate Commission if you purchase something through links on this page.

If you want to know more about the important elements of Options trading for beginners, you can see this Complete Udemy video on introduction to Options trading

Options give you trading leverage. It’s up to you to be careful to not overuse it. Remember, leverage is double-edged sword.

Tweet

If you buy an option on a stock instead of buying shares of the stock itself, you commit much less money than you would need to buy the stock outright.

There are two categories of options: Call options and Put options.

A call option gives the buyer the right to BUY the underlying asset.

A put option gives the buyer the right to SELL the underlying asset.

Since this is a comprehensive guide on the basics of Options trading for beginners, I will be talking only about plain “vanilla options” here.

Going long an option means buying an option while going short (or shorting) an option means selling an option. This is the same as going long and short an underlying asset. An underlying asset, by the way, is any asset such as stock or gold or forex.

I think the following Complete Udemy video on introduction to Options trading video is amongst the best ones out there. Click the video below to start watching. It comes with a 30-day money back guarantee. I can truly say that since I had availed it myself for a data science course 😉

All that you just read in the last few paragraphs are the essential fundamentals of Options trading for beginners.

Options trading example

Since this is a simplified article to learn Options Trading for beginners, I will provide basic but relevant examples of Option trading fundamentals in this Option trading tutorial.

Now let’s see how to carefully trade options with an example. Note that I have mentioned the correct options terms in brackets wherever needed.

Let’s say you want to buy a house listed at $100,000 (strike price).

Let’s assume you wish to wait or 3 months. You discuss this with your real estate broker. He speaks with the seller who agrees to sell the house at $100,000 after 3 months (expiry date or maturity date).

In return, he asks you to pay $5000 (option premium) as a insurance of your promise.

This explanation is a hypothetical example of CALL options trading for beginners.

There are 3 situations now.

- After 90 days, you don’t feel good to buy the house at the agreed price of $100,000. In this case you will lose the $5000 premium as well as the right to buy the house. Here, you can opt not to buy the house (not exercise the option) and simply let the contract expire.

- After 90 days, you pay the remaining $95,000 and take possession of the house (exercise your option).

- After 60 days (30 days before expiry), you find out that due to a shortage of these kind of houses, the market price has gone up to $120,000 for a new such house. In this case, since you had the right to buy the house, you go ahead and buy it for $100,000. Subsequently, you sell it in the open market netting you a profit of $115,000.

The option seller in all the cases pockets the $5000 option premium irrespective of whether you buy the house or not.

Note: The option seller (house owner) is OBLIGATED to sell you the house at the agreed (strike) price. Since an Option is like a promise to sell from a seller’s perspective, a buyer has to pay just a little premium so that the seller is made liable to honor his promise and deliver the underlying asset at agreed contractual terms.

Put Options:

To further explain Put options trading for beginners, I would say that it is just like an insurance policy. You can purchase put options to buy insurance on your portfolio.

For instance, if you fear that a panic / crash is approaching, and you want to protect (hedge) your portfolio, you can purchase a put option.

Why is options trading popular?

You might be keen to know why people generally trade Options. There are three reasons why people trade options:

- To generate consistent income - there are a few option strategies for beginners that help you get monthly income.

- To generate 10x short term profits – An options trader can use options to buy and sell his belief on the price movement of the underlying asset

- Hedge risks in their portfolio by buying Puts and using other types of Options strategies.

Options terminology

You need to know these key Options terminology to completely learn Options Trading for beginners. Options have the following characteristics:

- Strike price — contractually agreed price to buy or sell the underlying asset

- Spot price — current market price of the underlying asset

- Risk-free Interest rate — the current federal bank interest

- Volatility of underlying asset

- Time to expiry — number of days to Maturity date or expiry date

Strike price

Strike Price is $100,000, as described in the “buying a house” example. You can think of Strike Price as the contractually agreed price between the buyer and seller which will be used to exchange underlying asset and cash at maturity.

Picking the right Options strike price and maturity is the key to Options trading success

Spot price

The Spot price of the underlying asset is the current market price of the underlying asset. In the example above, the price of the house as seen after 60 days is the spot price at that date – $120,000.

Volatility

No Options trading tutorial is complete without describing Options Volatility. The volatility is a statistical measure of the fluctuation of price of an asset.

Higher volatility means higher Option price. This is because increased uncertainty boosts the expectation of possible larger price swings either side: up and down.

If the volatility of the underlying asset increases, big moves increase the probability of further moves.

Volatility is very important factor in deciding how to pick the right Options strike price and maturity. Let’s see this in the latter part of this article

Time to expiry

Option premium is directly proportional to time to expiry (or maturity). Time to expiry impacts the remaining option value (also called the time value).

For an OTM option with 1-week left to expiry, the option will massively loose its value with each passing day.

Given the same underlying asset, strike price, volatility and interest rate, an Option expiring in a week will be far less valuable than an option expiring in three-weeks. This is called time decay.

Most of the beginners who learn Options Trading and are excited to make big bucks generally forget this point.

They buy lots of cheap OTM options expecting the Option price to rise by the time it matures / expires. Keeping in mind this aspect of options terminology is the key to success.

In-the-money (ITM) and Out-of-money (OTM) options

Another important point in this learn Options trading for beginners series is the the concept of OTM and ITM. The Strike price with respect to Spot price can be used to define another Options terminology: OTM and ITM.

Based on Options terminology used in options trading tutorial, below are the differences between in-the-money and out-of-the-money options below.

| In-the-money (ITM) | Out-of-money (OTM) |

|---|---|

| An ITM option has a favorable difference between the underlying asset’s current price and Option strike price. | An OTM option has an unfavorable difference between the underlying asset’s current price and Option strike price. |

| For ITM call options, underlying asset’s current price is greater than the Strike price. In case of ITM put options, it’s just the reverse i.e. the underlying asset’s current price is less than Option Strike price. | For OTM call options, the underlying asset’s market price is less than the Option Strike price. On the contrary, for OTM put options, the underlying asset’s current price is more than Option Strike price. |

| For example, a call option has a strike price of $15 and the underlying asset’s market price is $13.5. This means the option is OTM. If after a week, the strike price rises to $16, the option will become ITM | Let’s say a put option has a strike price of $15 and the underlying asset’s market price is $13.5. This means the option is ITM. If after a week, the strike price rises to $16, the option will become OTM. |

An ATM option (At the money) is an option where the underlying Spot price is almost equal to the strike price.

Options trading for beginners in 5 steps

An Option is complex leveraged derivative instrument. It is not considered suitable for laymen and for inexperienced investors.

If you are thinking about making Options trading as a career, read the rest of this Options trading tutorial to understand how to trade Options profitably. Without any doubt I would again say, you should never consider Options trading as a side hustle.

Once you have decided that you want to start trading Options, you should follow the steps mentioned below.

1. How to pick an Options trading broker?

The first step in this options trading tutorial is to research on Options brokers. Find a broker that matches your preferences and has superb account features.

It is not just you, the trader, who ask the right to evaluate an options broker. You can interview the broker in certain aspects like he should at least know the basic options terminology.

I am not saying he needs to know even the simplest options strategies for beginners but at least he needs to understand the basic points used by beginners in option trading.

All options brokers almost always screen trading account applicants on the basis of their trading experience, understanding of the risks and their financial preparedness. They screen you on:

- whether you know basic options trading for beginners,

- have learned options trading from any course,

- are well versed with basic level options terminology.

An Options trading account requires huge capital. In this Option trading tutorial, I told you that to sell an Option, you require margin money to be paid to the broker before you initiate your sell trade.

Brokers have to know more about you in terms of your amount of total funds available, source of funds, risk appetite etc. before they allow you to start trading options.

I would suggest you pick an options trading broker after evaluating him on at-least the following 5 points:

a) Beginner level Options trading education

The most important part of this career is to educate yourself well so that you continue to trade Options profitably. However, you should never take Options trading as a hobby or just an experiment.

For beginners, Options trading is tough job. You do not want to get caught by a surprise massive loss if you do not xunderstand basic options terminology.

As a newbie into the world of trading, it is always good to learn as much as possible before “betting” your money.

You should choose a broker which offers basic to at least intermediate level of education in the financial instrument of your choice.

Apart from learning options trading through this article, ask your broker for some Option trading tutorial for beginners via the following means:

- Courses on basics of Options trading for beginners.

- Webinars on Options trading tutorial

- Books, PDF and other course material to learn Options trading in further detail

b) Choose an Options Trading platform

An options “Trader” doesn’t necessarily behaves like an investor. He generally trades between once a day to 10 times a day. Especially, in the latter case, you need a really good trading platform.

Note that the trading platform should assist you in selecting the correct Options strike price and maturity as well.

Fees and charges

It’s not mandatory that you choose a broker which has the lowest brokerage charges and other fees. A deep discount broker will obviously charge the lowest fees and charges while giving no service at all.

Services essential in Options trading for beginners such as assistance in opening an account, choosing an instrument to trade, tools to learn Options trading, analyzing your portfolio and giving recommendations will be available only with a full service broker.

But if you know options terminology well enough and what and why you’re trading, then there is no harm in choosing the broker with the lowest fees and charges.

Service and support

If you are a beginner in options trading, you might want to open an account with a full service broker such as a bank’s brokerage division or any other popular independent broking company.

Before signing the papers, check if the broker is available on live chat or 24×7 email or phone support.

Perhaps, test his knowledge by asking him basic options terminology, beginner level options trading, and later some detailed questions on Options Strategies for Beginners, and other technical & financial questions.

Customer Reviews

I personally do not purchase any important or pricey item before taking a look at several customer reviews on different websites.

Trustpilot and ForexPeaceArmy are 2 websites that I always surf to check forex broker or stock broker reviews to see whether they are good for options trading for beginners.

2. Open a trading account with your preferred Options broker

After you finalize the broker, you have to open an account. Every broker has different types of accounts but the general structure is as follows.

- For forex and CFD trading, account types fall in these categories: Beginner account, Standard account, Pro account.

- For equity and derivatives, account types are generally either cash account or margin account.

A cash account is an account where you require full payment upfront to buy a stock. Whereas, in a margin account, only part payment is required. The Rest of the money can be borrowed at a low interest rate.

Tweet

For derivatives, however, the margin account (another core concept in options terminology) is used to fund the margin required to trade N lots of your preferred derivative instrument.

For example, let’s say you want to buy AAPL stock as on 31 December 2020. In a cash account you will require at least $133 in your account to buy 1 share of AAPL as per the stock price of $132.69.

However, in a margin account you would need to pay anything between 10% to 50% of the stock price only. This margin percentage depends on your broker as well as your account type or account balance.

3. Learn and trade vanilla option strategies

Do not forget to educate yourself, at least with common Options terminology and basic vanilla Options strategies for beginners (in this section) if you want to trade Options in your career. Read as much as you can about Options strategies and learn how to best trade Options profitably.

The power of education extends beyond the development of skills we need for economic success.

— by Nelson Mandela

In this article, you can see basics of “vanilla” Options trading explained with a few examples. In the next section, I start with giving an example on how to use Stock price movement to further explain Options trading basics.

Thereafter, in latter part of this options trading tutorial, you will see simple Options Strategies for Beginners explained with few examples.

Using Options to make money from stock trading

Stock trading can be a lucrative business opportunity if used and executed wisely. If you do a Google search on how to make money from stocks, you will find at least 100 million results.

Even if you look at top 20 results, you will find several ways to make money from stocks.

However, the only issue in using stocks as a trading instrument is that even though you can find a broker which can give you leverage in stock trading, you will still have only limited leverage.

Huge leverage in intraday stock trading is generally restricted by all exchanges around the world.

4. Select the appropriate Option strike price and pull the trigger

There are several methods and reasons to anticipate the extent and duration of stock or index price move.

You may use Technical Analysis to predict those. You can have expectations based on news & views or some important analysis report or your own research.

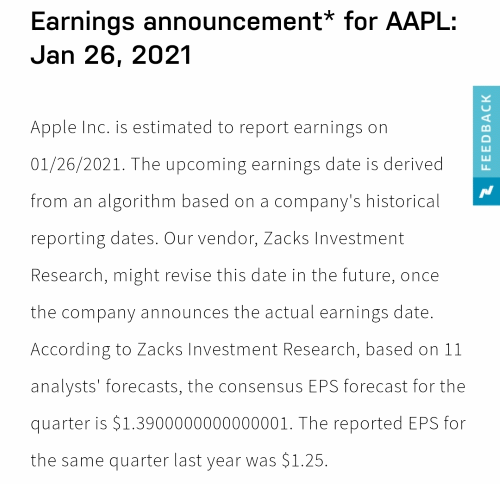

For instance, let’s say we expect Apple earnings to show an year-over-year decline after reading this piece of news.

Now we will buy put options if you want to cash in some profit because of the possible decline in AAPL stock price.

The prime question that a beginner needs to answer before trading options is how to select the correct Options strike price and expiry date?

You can see there are more than 50 different contracts of AAPL options just for one expiry date. And there are more than 10 expiry dates we can choose from.

For the sake of simplicity, we can choose the closest out of the money put option. As per this screenshot it is the $132 strike put option.

means that if the stock price of AAPL is less than $132 on 26 January 2021, our option will be in the money and we might make some profit.

Since the $132 option is the closest OTM one, it will obviously be priced a bit higher than the next closest OTM option.

You may also choose to instead buy the $131 option. But do not go too far out of the money. There is a high chance of the option expiring at OTM if you buy deep OTM options.

If you still have at least a faint memory of Options terminology you read in the previous section, you must have grasped what I just described as the basics of Options trading for beginners with AAPL as an example. If not, please read the Options terminology section once again.

5. Manage your exit and lock your profit

Exiting your trade at the right time at the right price is a very crucial yet difficult job for a beginner in Options trading. Emotions of Greed and Fear will prompt you to exit early or prevent you from exiting.

Let’s say you bought the $131 put option on 4-Jan-2021 at a price of $1.67. Now let’s say there was a sudden fall in AAPL stock. This means the put option will be in profit because when AAPL price falls, put option premium will increase.

The dilemma is whether you should sell it to cash in real profit or hold with expectations of a further fall to earn more profit. Your trading personality, and your experience will help you decide on this.

I also liked this video for a quick introduction to Options Trading for beginners.

Options Strategies for Beginners

Now, I will describe very simple vanilla options single trade Options Strategies for Beginners.

Buy a call option

This is the most popular and the simplest of all Options Strategies for Beginners. It involves buying a call option. You take this trade only when you expect the underlying asset price to increase.

If it rises in the future, the option’s premium will rise. You would then close this position by selling the option and net a handsome profit.

If in case you hold your option until expiry and the underlying asset Spot price is above the option’s strike price, your option will be in-the-money and profitable.

Upon expiry, you will get either the underlying asset (physical settlement) or the $$ amount equal to the difference in the current price of your option and your purchase price* (cash settlement). Do not forget the fundamental Options Trading terms.

* You will actually not get the difference between current option price and your purchase price due to a daily settlement behavior called Mark to market.

Buy a Put option

This is the also an equally popular and simple amongst all Options Strategies for Beginners. You take this trade only when you expect the underlying asset price to decrease.

If it falls in the future, the option’s premium will rise. You would then close this position by selling the option and would net a handsome profit.

If in case you hold your position until expiry and the underlying asset Spot price is less than the option’s strike price, your option will be in-the-money and profitable.

In these simplest Options strategies for beginners, you will get either the underlying asset or the $$ amount equal to the difference in the current price of your option and your purchase price upon expiry.

Sell a Put option

This is a risky Options Strategy for Beginners, and it’s best to not be used by people who are not and experienced in this area.

You need to learn options trading at a level more than a beginner. Most retail traders do not have substantial knowledge, experience or capital to get into this kind of trade.

Like I earlier said, the risk in selling a stock or selling a call option is equal to the current price of the stock multiplied by the number of shares in one lot of option (100 shares for any option in the American stock market).

This strategy technically is also another one of the simplest Options Strategy for Beginners. You take use this beginner Options strategy only when you expect the underlying asset price to not decrease.

If the price falls or stays the same in the future, the option’s premium will fall due to time decay. You should then close this position by buying back the option.

If in case you hold your position until expiry and the underlying asset Spot price is equal to or more than the option’s strike price, your option will be out-the-money and profitable.

Upon expiry, you will have to either deliver (physical settlement) the underlying asset. In case of cash settlement, you will pocket the $$ amount equal to the difference between current option price and your purchase price.

Naked call (speculation) vs. Covered call (income)

If you simply sell an option without holding the underlying asset, it is called naked option trading. It is far riskier to get into a naked option trade versus a covered call trade.

Covered call is the first of what I would call as little bit advanced Options Strategies for Beginners. You sell a call option on an asset that you currently hold.

As explained earlier, if at expiry, the Spot price of the asset is less than the strike price of the option you’ve sold, the option will expire out of the money. Since it will not be exercised, you will get to keep the premium as profit.

If you carefully evaluate and take this kind of trade regularly while holding on to your asset, then you actually earn a steady income without any risk of loss.

However, if the option at expiry date is in the money (option price more than at what you sold), it will definitely be exercised. The option seller in this case has to deliver the underlying asset, in case of physical settlement.

Since you are the option seller, and you already hold the asset, you are at a no-loss position when delivering the asset.

Had you sold a naked call, you would have to buy the underlying asset from the market at CMP (current market price) to meet your delivery obligation.

This strategy is a really good source of income if already hold the asset.

Just to remind you, when you are buying an option, your loss is limited to the option premium. However, if you are selling an option, then the loss is unlimited. Moreover, your profit is limited to the option premium you received.

I hope you enjoyed reading this article. In subsequent articles in this Options Education series, I will explain more on all the above-mentioned points and write more on some advanced topics.

Top Market News

Thank you for reading this article. I have written several other such Investment knowledge related articles in other sections on this website.

If you liked this post, kindly comment and like using the comment form below.